Understanding Chapter 7 Bankruptcy: Key Insights

Chapter 7 bankruptcy serves as a vital tool for individuals seeking relief from overwhelming debt. It is essential to understand what Chapter 7 entails, how it operates, and the implications it carries for your financial future. In this article, we will break down the fundamental aspects of Chapter 7 bankruptcy and provide insights into finer details that can significantly impact your journey towards financial recovery.

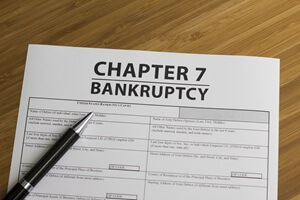

What Is Chapter 7 Bankruptcy?

At its core, Chapter 7 bankruptcy is a legal process designed to eliminate certain types of unsecured debt. While it is commonly recognized as a means to achieve debt relief, it is crucial to note that not all debts can be discharged through this process. Chapter 7 primarily targets unsecured debts, which can include:

- Credit card debt

- Medical bills

- Personal loans

However, debts such as student loans, tax liabilities, and child support obligations typically remain intact post-bankruptcy.

Debt Amounts: No Minimum Or Maximum

One of the unique aspects of Chapter 7 bankruptcy is that there are no restrictions on the amount of debt you can have to qualify. Whether your debts amount to $10,000 or $100,000, you can still file for Chapter 7 bankruptcy. This flexibility means that if you’re contemplating bankruptcy but unsure if your debt qualifies, it’s advisable to consult with a bankruptcy lawyer. They can help assess your situation and guide you through the process.

The Legal Process Of Chapter 7

Chapter 7 bankruptcy cases are handled in specialized courts that focus solely on bankruptcy proceedings. While there can be instances where you may need to argue your case before a judge—often due to disputes between creditors and debtors—most cases proceed without such confrontations. Instead, you will interact with a Chapter 7 trustee during the process.

The Role Of The Chapter 7 Trustee

One of the critical components of a Chapter 7 bankruptcy case is the Chapter 7 trustee. This individual is appointed to oversee your case and ensure that the process is fair to all parties involved, particularly the creditors. The trustee’s duties include:

- Reviewing your filed documents for accuracy

- Conducting the 341 meeting where you will answer questions regarding your finances

- Identifying and liquidating any non-exempt assets to pay creditors

It is important to be prepared for this meeting, as the trustee will scrutinize your financial situation to ensure transparency and accuracy in your filings.

No Asset Cases Vs. Asset Cases

Another significant aspect of Chapter 7 bankruptcy is understanding the difference between asset and no asset cases. In a no asset case, the debtor has protected all their property using exemptions, meaning there are no non-exempt assets for the trustee to sell. It’s a common misconception that no asset cases imply the debtor has nothing; rather, it highlights the effectiveness of utilizing available exemptions to safeguard assets.

Qualifying For Chapter 7: The Means Test

To file for Chapter 7 bankruptcy, you must pass the means test. This test evaluates your income against your expenses and determines your disposable income. The results of the means test will ultimately dictate your eligibility for Chapter 7. Understanding this test is crucial, especially for higher-income earners who may feel they should qualify but find themselves facing complications.

Finer Points Of Chapter 7 Bankruptcy

In addition to the key points mentioned, here are some finer details to keep in mind:

- Filing Fees: There is a filing fee associated with Chapter 7 bankruptcy in addition to any attorney fees.

- Credit Counseling: You are required to complete two credit counseling classes before proceeding.

- Transparency is Crucial: Honesty is paramount throughout the process. Failure to disclose accurate information can lead to severe penalties, including criminal charges.

- Speed of Process: Chapter 7 cases are typically resolved quickly, with most discharges occurring within four to six months in no asset cases.

Summary

Understanding Chapter 7 bankruptcy is essential for anyone considering this route for debt relief. It provides a pathway to eliminate unsecured debts and offers a fresh start. If you are in Central Texas and need assistance navigating your bankruptcy options, contact Austin Bankruptcy Lawyers for a consultation. We’re here to help you reclaim your financial freedom.

& Let’s Discuss How We Can Best Help Eliminate Your Specific Financial Struggles!